Command

your payments

down to the second

Make payments. Make money in seconds.

Launch Real-Time Payments through an API in 1 day

The instant payment revolution is 24 / 7 / 365

-

Merchants can stop stressing over fraud, chargebacks, disputes, and refunds. Real-time payments are instant, final, and irrevocable.

-

The sender pre-funds an FBO account, which is FDIC-insured. We recommend at least 2 weeks of payments volumes into this FBO account.

-

Today over 70% of demand deposit accounts (DDAs) are already RTP enabled. Our API will initiate same day or standard ACH if accounts are ineligible for RTP

Deliver delightful experiences

through instant payments

Instant Account-to-Account transfers

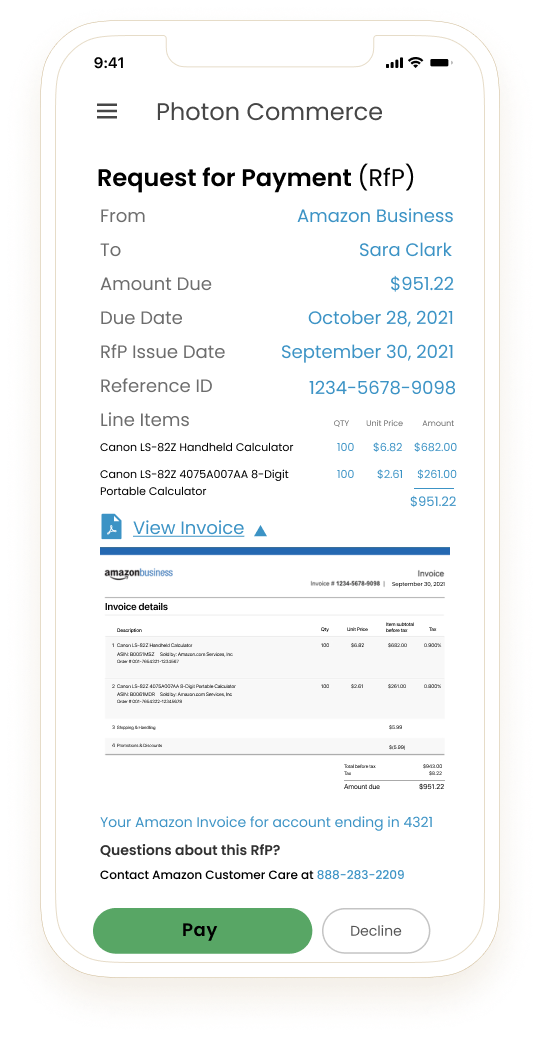

Embed invoice and remittance details directly into the Request-for-Payment for instant Straight-Through-Processing

Automatically standardize any invoice and PDF into an ISO 20022 message

The fastest payment method infused with AI remittance data

Enrich any payment instruction with line item details and over 100+ reconciliation data points

Photon partners with fintech leaders, processors, issuers, and merchants to accelerate migration to the ISO 20022 standard through instant APIs

-

Use cases: Bill pay, B2B invoicing, factoring, supply chain finance, gig economy disbursements, early wage access, payroll, reimbursements, insurance disbursements

-

The API includes instant KYC/KYB, where new accounts just need names, EIN/SSN, and addresses

-

RTPs are instant and irrevocable, so there is no automated return or chargeback like ACH or cards. FIs have the option to request funds returns, but the receiving FI is not obligated to return funds.

Real-time bill pay, reconciliation, and analytics

Cut payments costs by up to 33%, through card, ACH, or check

Phone, credit card, electric, water, insurance, medical, car bills... Believe it or not, 40% of bills are still mailed and processed on paper

Make opportunities come to light by gaining visibility into spend, transactions, and trends

Instant processing and instant payments Pay any invoice on your terms in 1 click

Put payments and invoices on autopilot

Snap a photo of any bill or invoice. Get paid or pay in real-time

Real-Time Payments (RTP), Request-for-Payment (RfP), and invoicing rolled up into an all-in-one API solution

-

Convenience: With instant payments, you can send and receive money instantly, without having to wait for bank transfers or other traditional payment methods to clear.

Security: Instant payments are typically processed through secure networks and use advanced authentication methods to ensure the safety and security of transactions.

Increased efficiency: Instant payments can help businesses and individuals save time and money by eliminating the need for manual reconciliation processes and reducing the risk of errors or fraud.

Greater control: With instant payments, you have more control over your financial transactions and can monitor your account balances in real-time.

Improved customer experience: Instant payments can help improve the customer experience by providing a faster and more convenient way to pay for goods and services.

Overall, instant payments offer a range of benefits for individuals and businesses alike, including convenience, security, efficiency, control, and improved customer experience.

-

Real-time payments are electronic payments that are processed and settled in real-time, typically within seconds or minutes. In the United States, two major players in the real-time payment space are The Clearing House (TCH) and FedNow.

The Clearing House is a financial technology organization that operates a real-time payment network called the Real-Time Payment (RTP) network. The RTP system is a 24/7 network that enables real-time clearing and settlement of payment transactions, including ACH, check, wire, and card payments. The RTP system is used by banks, credit unions, and other financial institutions to facilitate real-time payments for their customers.

FedNow is a real-time payment service being developed by the Federal Reserve Bank of the United States. FedNow is intended to provide a real-time payment and settlement service for banks of all sizes, including smaller institutions that may not have the resources to participate in existing real-time payment networks. FedNow is expected to be available to financial institutions in 2023.

Both The Clearing House and FedNow offer several benefits to users, including increased efficiency, security, and convenience. Real-time payments can help businesses and individuals save time and money by eliminating the need for manual reconciliation processes and reducing the risk of errors or fraud. They can also improve the customer experience by providing a faster and more convenient way to pay for goods and services.

While The Clearing House and FedNow are both major players in the real-time payment space, they are not the only options available. Other real-time payment systems, such as Zelle, Venmo, and PayPal, also offer fast and convenient ways to send and receive money. Ultimately, the best option for you will depend on your specific needs and preferences.

Instant payments, transfers, and payouts using Real-Time Payments (RTP) and push-to-debit that settle in seconds

Control payments and cashflow precisely down to the minute

Turn your camera into a POS system

Mobile bill pay infuses intelligence into any camera, scanner, and app

Photon's API drops into any app, creating a key data bridge between your camera and your other apps

See our API documentation, and book an assessment below to access a developer account