Autopilot for your Commission Statements processing

Commission reports, direct & agency bills, payment records, claims forms, and 45 other Insurance documents automated with 99.5%+ accuracy

Instant AI extraction with optional Human-In-The-Loop (HITL) QA processing

99.5-100% accuracy for the Insurance Industry

Accelerate claims processing by 3000x using AI

End-to-end digitization of over 1600 insurance carriers, agencies, brokerages, and data formats

Photon Commerce powers seamless data extraction and digitization from top carriers and agencies like UnitedHealthcare, Elevance Health, Unum, Guardian, Principal, Cigna, BlueCross BlueShield, Philadelphia Insurance, and The Hanover Group. We automate and standardize commission statements, remittance reports, and policy documents into structured, usable insights.

Insurance commission statements

Insurance Documents, often delivered as scanned images, emails, or non-standard PDFs, have traditionally posed challenges for data extraction and accuracy. These statements are among the complex and variable financial documents. Photon Commerce transforms these diverse formats into structured, machine-readable data (CSV, JSON, etc) – ready for ingestion into your CRM, ERP, or analytics platforms.

AI for insurance data extraction

Our latest AI models are specifically trained to interpret the unique language and layouts of Insurance Commission statements. Whether your documents are in clean text PDF format or noisy scans, our system intelligently extracts essential data points—customer IDs, policy numbers, policy type, commission rates and amounts, and more.

99%+ Accuracy SLA guaranteed

Photon Commerce delivers industry-leading accuracy with a 99%+ extraction guarantee. Outputs in CSV or JSON format are immediately ready for system integration, eliminating the need for manual verification or secondary QA.

Our proprietary models are purpose-built to interpret and digitize even the most complex commission formats—delivering structured outputs such as JSON or CSV with up to 99% accuracy. Whether you're dealing with brokerage statements, agency summaries, or reconciliation reports, our system extracts critical fields like agent ID, policy number, commission amount, and payment dates with precision.

Automate insurance documents at scale

< 5

seconds to process

98% ↓

lower processing costs and efforts

0

Training or Resources needed

Benefits

Supports Any Format: Scanned images, faxes, low-quality PDFs, or clean text PDFs.

Structured Outputs: Clean JSON or CSV—customized to your schema or standards.

Real-Time Ingestion: Automated pipeline support for continuous data processing.

Security-First: SOC 2 Type II and HIPAA-aligned infrastructure for sensitive financial data.

Enterprise Scale: Built for high-volume document ingestion across carriers, brokers, and agencies.

Human-in-the-Loop Accuracy: Combine AI with expert review to guarantee 100% accuracy for critical insurance data.

Seamless Integration: Easy plug-and-play via REST API, SFTP, or Cloud Storage integrations (AWS S3, GCP, Dropbox, Google Drive).

Use cases

Brokerage & Agency Automation: Automatically reconcile commissions across carriers.

Revenue Intelligence: Feed accurate payout data into dashboards and analytics tools.

CRM & ERP Syncing: Connect commission data with agent performance and policy metadata.

Built by experts in document intelligence

PhotonCommerce is trusted by top fintechs and enterprise data teams. Our proprietary AI, trained and refined on millions of structured and unstructured documents, is now tailored and optimized to meet the complex & unique challenges of the Insurance industry.

Detect anomalies and potential fraud in commission statements and claim forms

Parse complex commission breakdowns, carrier statements, and policy transactions—line by line

Extract structured data from EOBs, remittance advice, and claim forms with 100% accuracy

Normalize and enrich data across multiple carriers and formats, ensuring consistency and control

Instantly convert complex unstructured documents to clean actionable insights

Every insurance document, whether it’s a commission statement, claim form, or remittance advice, comes with its own layout, formatting quirks, and inconsistencies. Manually handling these documents is slow, error-prone, and resource-intensive.

Our AI engine reads even the most complex or low-quality files, intelligently extracts key data fields, and delivers them in a structured, machine-readable format. From line-level payout breakdowns to policy and agent metadata, we ensure 100% accuracy and instant usability. Whether you're automating workflows or syncing to your CRM or ERP, our extraction pipeline helps you go from raw document to reliable data, instantly and reliably.

What we handle

Clean Text PDFs, Scanned PDFs, or low-resolution images

Multi-page commission statements and claim packets

Inconsistent layouts from different carriers

Handwritten notes, stamps, and annotations

What you get

Clean JSON/CSV, ready for ingestion

Line-by-line breakdowns of commissions and payouts

Accurate mapping to your internal schema or CRM fields

Validations and sanity checks for every field

Standardize any insurance data from PDFs, scans, images

Policy & Account Data

policy number

policy type

insurer name

insured name

agent/broker name

policy start date

policy end date

premium amount

commission rate

policy status

underwriter

product line

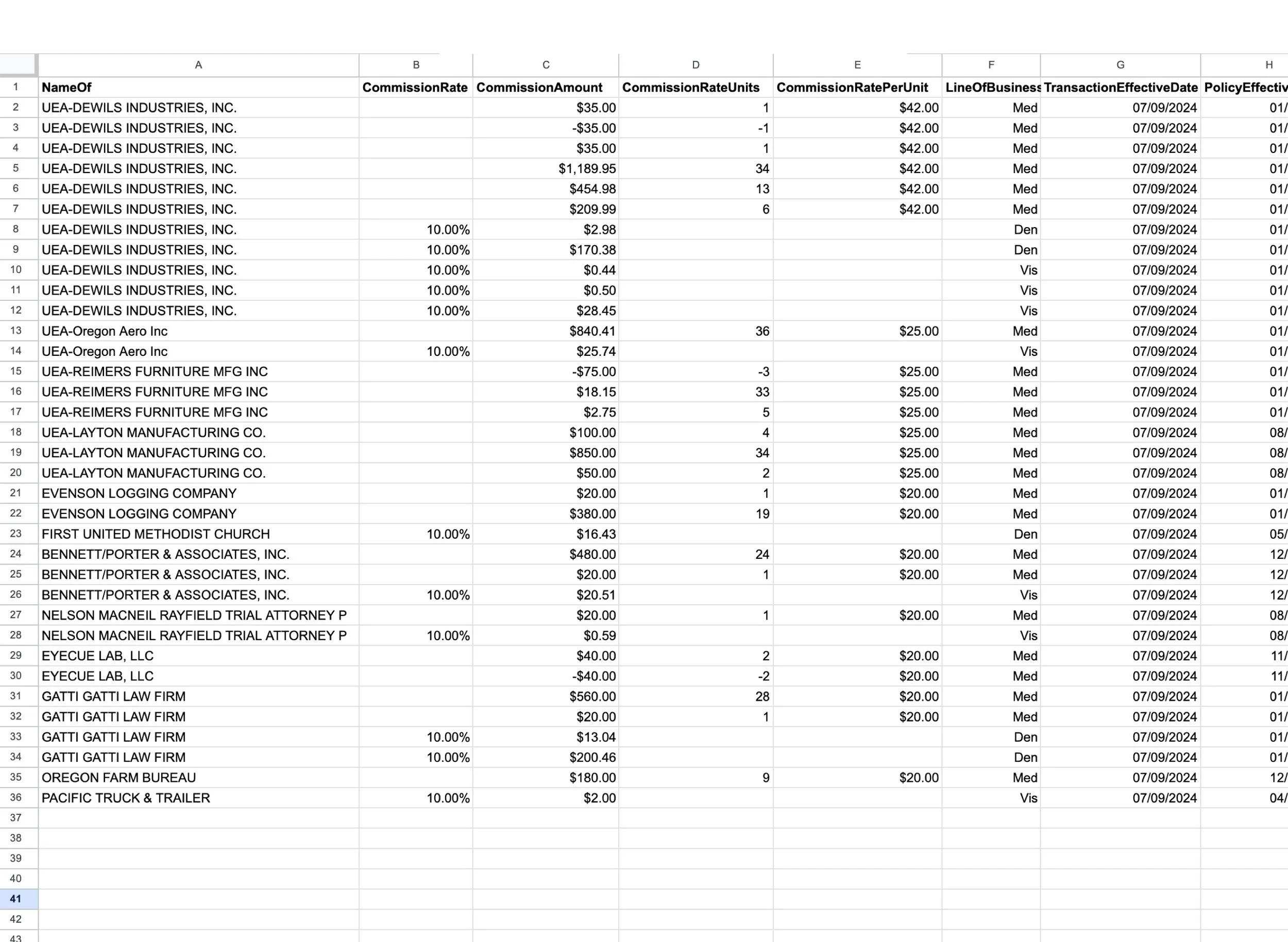

Commission Statement Fields

name of

commission rate

commission amount

commission rate units

line of business code

transaction effective date

policy effective date

gross amount

policy number

corporate entity name

npn code

transaction type code

policy expiration date

sub policy number

secondary policy date

plan type code

Claim Form & Remittance Data

claim number

claim type

claimant name

loss date

date filed

payout amount

approved amount

deductible

CPT/ICD codes (for health claims)

payment status

provider name

remarks/notes

Per-Line Transaction Fields

transaction ID

line item description

coverage type

service date

billed amount

approved units

denied amount

reason codes

provider NPI/ID

benefit category

adjudication status